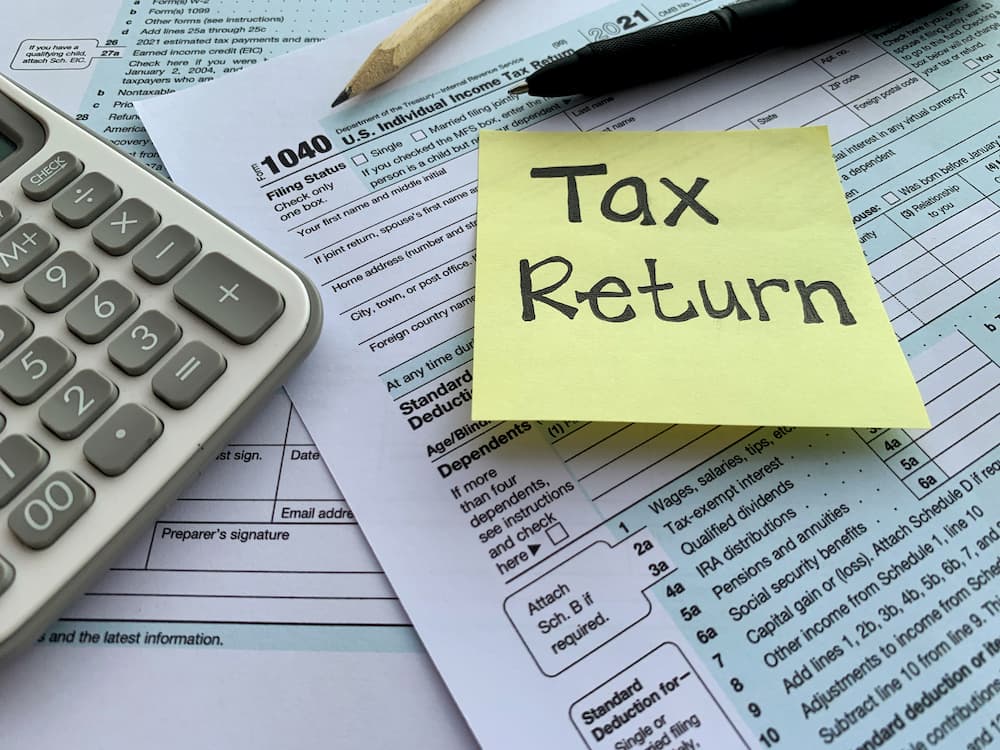

Most Common and Important IRS Notices and Letters

It is no secret that dealing with the IRS is a confusing, painstaking endeavor. Receiving

Gregory Law Group, PLLC has 25 years of combined experience working inside the IRS as Former IRS Attorneys.

Gregory Law Group, PLLC is a boutique law firm located in Dallas and Addison, Texas (by appointment only). The firm’s areas of practice include income tax, international tax, corporate and partnership tax, and business and estate tax planning. The firm represents individuals and businesses before the Internal Revenue Service on domestic and international tax issues in all phases of the audit, appeals, and collection processes. The firm represents taxpayers before the United States Tax Court.

If you’ve received a Notice of Intent to Levy or a Federal Tax Lien, you may have 30 days or less to respond before the IRS begins enforcement.

Our founders, Garrett and Deborah Gregory, worked as Senior Tax Attorneys for the IRS’ Office of Chief Counsel for over 24 years combined in Washington, D.C., Dallas and Addison, Texas. They both served on the International Field Counsel. Mrs. Gregory was the FBAR Coordinator for Area 4 (Chief Counsel) and Mr. Gregory worked at the National Office Headquarters of Chief Counsel in the International Tax Group, Branch 5 (Financial Institutions and Products).

As former IRS Attorneys, Mr. and Mrs. Gregory worked with Large-Mid Size Business & International IRS teams on their audits and represented the IRS in Appeals. They reviewed, negotiated, and settled civil cases before U.S. Tax Court. They also provided legal advice on complex domestic and international tax issues to various IRS divisions. They have unique institutional knowledge of the IRS. Mr. and Mrs. Gregory understand the complexity of your IRS tax problems and will work hard to resolve your tax disputes with the IRS.

We know the IRS from the inside.

We've helped clients resolve millions of dollars in tax debt.

No sales reps. No runaround.

Serving clients across the DFW metro and nationwide.

Very few law firms focus solely on tax defense and planning. Even fewer boast a founder who has the experience as a former IRS attorney for 24 years (combined). Call our office today at (888) 346-5470 and schedule a free consultation.

It is no secret that dealing with the IRS is a confusing, painstaking endeavor. Receiving

The Unique Risks Faced by Tax Return Preparers Tax return preparers play a vital role

Why Compliance Training Matters for Tax Return Preparers As former IRS attorneys, we at Gregory